Learn with our products

1. The first misunderstanding about the price of a stock is this incorrect statement:

“The stock price will rise when there are more buyers than sellers,

and stock price will drop when there are more sellers!”

2. That is a totally wrong-headed statement. The fact is there must be a buyer for every sale, and likewise, there must be a seller before someone can buy. Any transaction requires both parties! But where did this misunderstanding come from?

3. A better statement would read:

“Prices will rise because potential buyers,

outnumber potential sellers!”

4. This means buyers are more eager than sellers. Because of this, it is the buyers who must compete to find sellers, and therefore give or make concessions.

5. This scenario plays out continually in “auction format” every day in the market. Think of a stallion with prized credentials at an open auction. The seller is one party hoping to get the maximum possible, while there are a few potential buyers hoping to get the horse for a lower price. In the end, one buyer will make the transaction with the one seller for one price. But why will the stock price move up during the auction process? The enthusiasm of potential buyers bidding against each other, until one buyer takes the prize. The buyer and the seller reach an agreement on one price and the transaction takes place.

6. On the other end;

“Prices will drop because enthusiastic sellers

outnumber enthusiastic buyers!”

7. Sellers, trying to shed or get rid of unwanted holdings, will accept less than they would like to get, thus decreasing the resulting sale price.

8. That is a long explanation of what goes on continually in the daily market and why the initial statement in this dialog is so often quoted. If somehow there were several stallions for sale at the same time during the auction, the resulting price would likely be less, as sellers make concessions. Note: It is not the fact of the number of buyers at the horse auction, but the concessions, the emotion, the enthusiasm of those in the market that cause stock prices to go up or down!

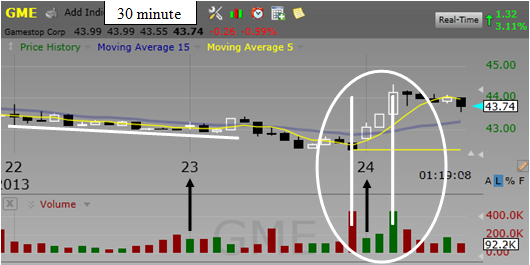

9. Look at the next chart with price activity highlighted by the white oval. This pattern (a 30 minute bar chart) shows a lackluster decrease during the 22nd until a drop in the last part of the 23rd saw sellers unloading stocks. Notice the spike in volume the last half-hour of the day. The first three bars of the 24th saw buyers taking charge with increased buying volume pushing the stock price up over 3%. What we must understand and get a feel for is the emotion that was in play during these two days, the 23rd and the 24th. This is the play that helps determine the stock price in the market.

Fig. 1

“One of the funny things about the stock market is that every time one man buys, another sells, and both think they are astute.” William Feather

In a word – INSIGHT!