Risk tolerance is important to understand. It will help you protect the discretionary money you are looking to trade. The products in the link give you tools to manage risk.

Learn with our products

We congratulate you for taking this first step to assess your own risk tolerance. Brave people want to know what’s inside! Often, you don’t know how you’ll react under different conditions, but this little exercise will open your eyes to what might be! AND, to where a better understanding of market principles and strategies can take you.

Whenever you master a new challenge, it always comes at an expense. That is, it took some work to accomplish. Usually, the greater the challenge, the more work that is required. Call the new challenge a reward and the required work a sacrifice. We invite you to make the sacrifice, reap the reward. In some circles, it’s called the Law of the Harvest. If we don’t sow the seed, we needn’t worry about any harvest. Others call it the Law of Cause and Effect; for every effect, there is a cause. Reward and sacrifice go into every worthwhile effort, including trading in the stock market. In the market we call the investment reward the return. Return is the financial benefit of risking our money in the market. It is expressed as the “rate of return.”

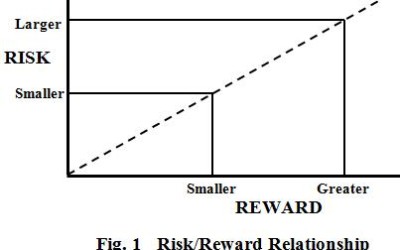

Investment sacrifice is called risk. Risk takes many forms, but the essence of investment risk is the chance you take that the value of your investment will decline. You are ready to tackle the simple fact that underlies trading risk and return and how they are related. This simple graph is worth a thousand words, showing this relationship.

The risk/reward relationship implies that higher returns (rewards) come with higher risk. If you’re unwilling to accept a higher risk, your returns will be accordingly low. In the long term, all investment securities and portfolios operate this way. Furthermore, the relationship explains why get-rich-quick schemes don’t work: to get rich quick, you must assume extraordinary risks that significantly increase the probability of loss. Rather, the key to successful trading lies not only in a well thought-out plan, consistently applied, but one that accounts for and manages risk. The cornerstone of good risk management lies in an accurate understanding of your own tolerance for risk.

As your confidence level grows while learning and understanding risk controls, tools, and the importance of paper trading, your risk tolerance will change.

Self Exam for Risk Tolerance

We have provided this self-exam to assess your own risk tolerance. We feel you will find questions that deal with how you react in various circumstances. Exercises like this will help you examine your comfort zones in making investment decisions.

Answer the following 12 questions, we’ll keep track of your answers:

[WATU 1]