Trading Volume matters and is considered only second to price among the many indicators that can increase wins. The dozens of free tutorials will give you an edge. The products we offer give an organized foundation and step by step education.

Learn with our products

Volume:

1. To understand what an increasing price trend (or downtrend) means, we look for technical clues. Is the increase real, should we pour money into the security? Or is it a random change without significance? Likewise, does the recent downtrend spell disaster, should we sell and get out for what we can, or hang around for a recovery? Good questions. The real question is “what is the market telling us about a particular stock (or the market) in general?” When we learn to listen for “market” messages, we increase our odds for success. Volume is key to these market messages.

2. The difficulty in technical analysis lies in the number of indicators we can watch and listen to. There are so many things to look for, where to look first? The price pattern itself is the most important message we ever will get. Following closely in second place is volume, or the number of shares traded as the price pattern develops. Volume is the focus of this Guideline…and Trading Volume matters!

3. To understand market forces that cause volume and price changes, we must know the impact of institutional investors; Mutual Funds, Insurance Companies, Pension Funds, etc. The reason is simply size. Up to 80% of the stock market volume is accounted for by these big institutions. When these guys find a stock they like, they buy huge blocks of shares worth hundreds of thousands or millions of dollars. However, they need to acquire those shares slowly and patiently to avoid driving the price up before they reach their goal. The same is true when they want to sell. Think what would happen to the price of XYZ if a fund put in an order to sell 500,000 shares! They must dispose of their shares gradually to keep the price up before they unload all their stock.

4. With that under our belt, let’s look at our first general rule for volume:

-

Volume matters because normally follows the price trend. Price and volume increasing together is normal, with volume confirming the price. Price increases usually result from volume increases. This means the volume increase normally comes first, with volume leading the price. Decreasing volume will have a like effect, leading ahead of a price decrease.

5. The price and volume chart (Fig. 1) below is for the ticker ARII, showing the price and volume correlation from June and July. The bars at the bottom show the increased volume corresponding to increase price in three segments shown.

Fig. 1 Price/Volume Chart for ARII

6. Notice also, that in this case volume changes slightly lead price changes (A).

7. We are careful to use the words “normally, likely, usually, probably” etc., in any discussion of market action. There will always be the exceptions, the case studies that fly in the face of rule and logic. That does not diminish the value of the rules and generalities. Rather, it helps us understand the principle of gains and losses. We will always have both. Our goal is to increase the likely-hood of over-all larger gains and smaller losses. That is why we are discussing volume.

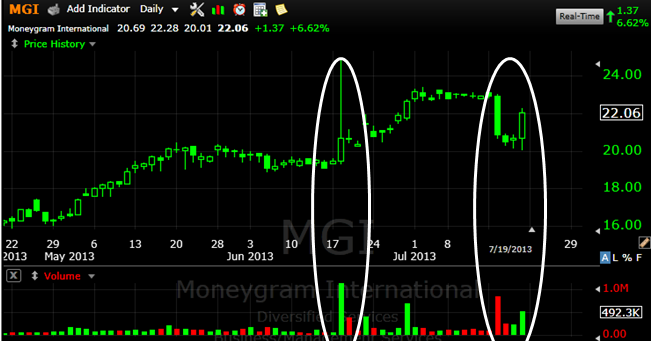

8. Figure 2 is a daily chart for MGI, from May into July. In this case, the volume bars are difficult to read relative to the price pattern. But we can see the correlation between price and volume in the latter part of June past the middle of July. This confirms our first general rule about price following volume.

Fig. 2 Price/Volume Chart for MGI.

9. This chart was used to demonstrate another tool for our use. We can change the scale of our price chart from a daily to a weekly pattern. In the next figure, let’s take the same price pattern but change it to a weekly scale. In this case, each data point on the chart is a weekly value (the close on Friday, the total volume for the week). Notice how there is less noise in the volume bars and how much easier it is to see the big picture. While it is important to watch price action each day, weekly charts get you out of the trees to see some of the forest.

Fig. 3. Weekly Price/Volume Chart for MGI.

10. Does this weekly chart (Fig. 3) make analysis a bit easier? Why don’t we just show all Price/Volume charts in a weekly format? The reason is fundamental! We want as many focal angles on a price chart as possible. On most charting software programs, to go from a daily to a weekly format is as difficult as a click of the mouse. We can go back and forth, increasing our understanding of the big picture, as we do.

11. One of the biggest big-picture understandings a weekly chart provides is where the institutional money is flowing. Remember, they are responsible for 80% of the volume. We can sense institutional distribution (selling) and accumulation (buying) easier with the weekly chart format.

12. Before we leave this introductory Guideline on volume, let’s look at a Price/Volume chart of a recent pattern, UAM. This illustrates an example of our second general rule for volume:

-

When volume does not follow the price trend, an abnormal case exists. This divergence broadcasts a powerful message we must listen to. When prices rise with decreasing volume, the rally is weak and not likely to continue. Or, when price falls in the face of increasing volume, look for a recovery. In other words, whenever volume does not confirm the price action, a red flag should go up. Trading volume matters even when it is decreasing.

13. First the daily chart in Fig. 4:

Fig. 4 Daily Price/Volume Chart for UAM.

14. Now compare the weekly chart in Fig. 5:

Fig. 5 Weekly Price/Volume Chart for UAM.

15. As the price increased from mid-October through December, there was no confirmation of this action with volume. The rally died without volume support. It tried to rally again but volume still does not provide confirmation. Where to you think the price is headed next?

16. Figure 6 the power of the technical analysis tool, Volume. There are easier ways to utilize this tool which we will discuss in future Guidelines.

Fig. 6 UAM going forward – You guessed it! Volume helps understand why!

“Volume confirms the price trend. If both are moving up together, the uptrend is healthy. However, if prices are moving higher while the volume line is dropping, a negative divergence exists, warning the price uptrend might be in trouble.” John J. Murphy

In a word – INSIGHT!