Learn with our products

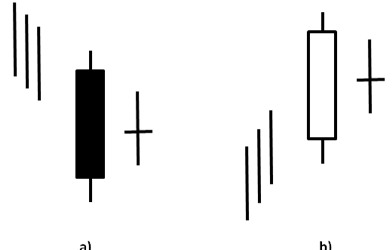

Candlestick Patterns are formed because of the collective buyer and seller sentiment (emotion) in the auction market-place. More particularly, the patterns reflect changes in investor sentiment. For example, study this candlestick pattern and consider how emotions might be changing as time moves from left to right. Fig. 1 is kind of a blur at first sight, but we’ll see there is gold in the candle messages.

Fig. 1 Candlestick pattern.

We discussed the simplest Candlestick Pattern (the Doji) in an earlier Guideline. Recall the Doji occurs when the opening and closing prices are equal (or very nearly so). This pattern suggests indecision, a holding place where buyers and sellers have not made up their minds. We showed how the Doji could occur at turning points, both bottoms and tops, which begs the question: “How can we use the Doji as a trading signal?”

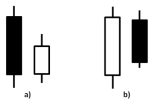

Fig. 2

Fig. 2

Figure 2 shows the several possible Doji’s. Find the simple answer within the Candlestick patterns that lie to the left and to the right of the Doji. A single Doji cannot signal a profitable trade! Rather, how the Doji is placed around, next to, before, and/or after a few critical candle partners can broadcast powerful trading messages. It is these messages that increase the trader’s profit-making abilities.

For example, Fig. 3-a shows a long candle at the end of a down-pattern followed by a Doji, whose open and close (the same) are within the open and close on the previous candle. Fig. 3-b shows the same scenario at the end of a rising pattern. Both cases signal a change in market emotion with the Doji’s suggesting a marked indecision.

Fig. 3

The two-candle patterns shown in Fig. 3 designate what is called a Harami-cross with the cross being the Doji. These occur when a long day occurs in a trending market, followed by a Doji. Look at these two patterns carefully. These designate strong reversal patterns with the previous trends being questioned by traders. It is the strong message of the Doji-indecision that raises the question; look for a change in the trend.

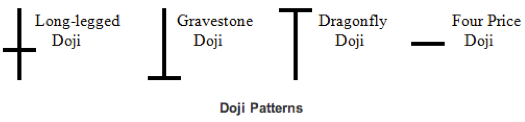

The Harami-cross is but one example of a Harami Candlestick, which occurs whenever a long day is followed by a shorter day of opposite color. The open and close prices designate if the second candlestick satisfies the requirement. That is, the shadows are not relavent. A bullish Harami (Fig. 4a) has had a downtrend in place for some time. The latest candle in the downtrend is followed by a shorter bar of opposite color. The Harami definition requires the open and close of the white candle be within those of the preceding black candle. The opposite can be said about bearish Harami shown in Fig. 4b. In this case, the increasing trend is shocked by the reversal and provides a turning point in the pattern.

Fig. 4 Harami

Given that introduction to the Harami, let’s revisit the chart we opened with (Fig. 1 repeated below): Notice the Harami circled in white. This is a bearish Harami, signaling a change in the emotional character of this market. What is a signal like this worth for the trader to make preparations? A rhetorical question…

Fig. 5 A welcome warning!

Candlestick analysis provides the trader a powerful advantage; a clear platform for buying at the bottom and selling at the top. Understanding the accuracy of bottoming signals can remove the emotion of getting into a position. The same can be said of topping patterns, how the high probability of exit signals can greatly diminish risk. The cost of this seemingly simple gift is one of patience and discipline. It is not a free gift!

“Never let your head hang down. Never give up and sit down and grieve. Find another way. And don’t pray when it rains if you don’t pray when the sun shines.”

Satchel Paige

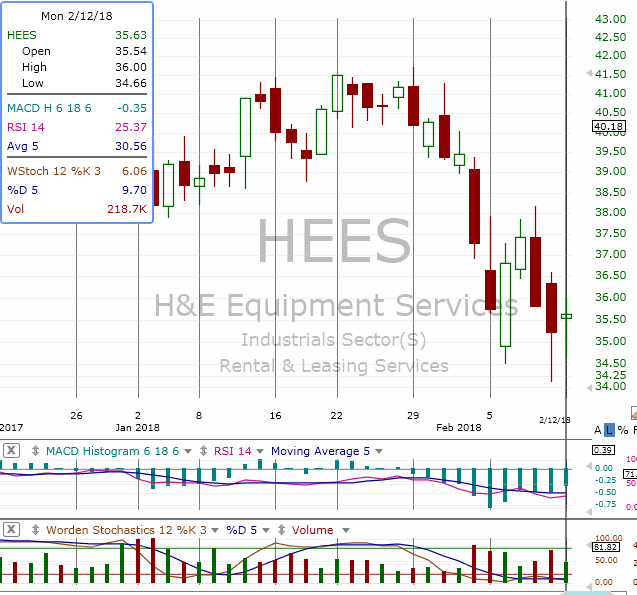

What do Candles say about what’s next in HEES (The Doji)? Do Stochastics support this view? How about the MACD?

In a word – INSIGHT!