Swing Trade-a winning strategy

To Swing Trade, you need a solid foundation. This is key for any serious endeavor. We recommend strongly, that you get that from the book and the home- study course offered in products. We have also provided dozens of full free tutorials to increase your understanding. Give yourself something solid to build upon.

Learn with our products

When we put our small child on their first bicycle, it was a with the use of training- wheels. As they matured in the use of this new machine, they slowly developed a feel for the bike until they had the stability and understanding to remove the training-wheels. And like they say, you’ll never forget how to ride a bike. The reason for that progress is built into the process and the first process step is knowing what you want (desire, need, hope for, etc.)

Knowing what we want to experience MUST be followed by the second step: learn all we can about the activity, consider the risks, what can go wrong, preparing for any hiccups or false moves that might detract from a successful outcome. For the child on the bike, certain protective steps were used like the training wheels and a protective helmet.

Finally, we did it! And don’t we all remember the shouted instructions to the child on the bike and with parent trying to keep up to catch any fall. “Pedal a little faster… Wait, slow down a bit… Turn the handlebars in the direction you are going to fall… Don’t use your feet to stop…” After valuable suggestions and encouragement, things worked together, and with a big grin the child sped off

Reflecting on the simple three step process, the order of the steps is important. We didn’t say to the child, “hey kid, jump on and ride off, see you when you get home!” We talked about what was about to take place, the coming event. This dialog, this exchange of views is essential to a successful outcome. Then the actual event, the pedal to the metal, as it were.

But what has all that to do with a swing trade in the market? For beginners the process is much the same. Let’s take a new ride on a bike called the stock market and see where it takes us. The first question is what do we want? The knee-jerk response is usually financial freedom, but there are many dimensions to that response. What will financial freedom do for you?

Next, having identified a valid reason for this effort, how can we learn about the stock market and its many facets? The market has countless dimensions as we learn how it all works. And this learning effort must be organized for that initial bike ride to make sense. Too much, too soon leads to confusion and a short experience in the market. That’s why 90% of beginning investors fail in their initial market effort. They’ve been told to jump on that bike and we’ll see you down the road! What a terrible waste without thoughtful and patient mentoring. Their own instincts with needful instruction can devise a plan to bring the desired reward.

Beginning investors/traders have a tough time with all the market forces shouting yo here and yo there! Many offerings are available for market trading courses in the literature and on the web. Bigger and better, more colorful, more bells and whistles, and Wow! All we could ever hope for in the world of investment and finance. This is the most critical element in the process we’ve been describing. Pay very strict attention to what is promised against what is realistic. If it sounds too good to be true…

Back to reality, how about a big picture view of In this journey as shown on Fig. 1. This is the Standard & Poor’s 500 chart, considered the benchmark index for how the market is performing. This picture punches up the dramatic change in the character of the market from where our parents and grandparents believed very rightly that the market was the place to stash your money. The market always just went up. It could be depended on! This dynamic market economy seemingly could do no wrong. It was certainly a buy and hold market.

Fig. 1 Standard and Poor’s 500 Market Index

Then, look what happened around 1999 – 2000. The market turned sideways, creating quite a different set of opportunities and challenges. This introduces us to what is called a swing trade environment.

Fig. 2 S&P500 Current Sideways Character

Another childhood memory was being pushed in a swing to heights untold, by a loving parent. Much like the chart in Fig. 2 which has been characterized as a swing trade market. A key feature of our our book “Provident Investing” teaches swing trade strategies and the details that make this a profitable trading effort. The new character of the market is much like taking a breath – we breath in and we breath out, or like our pulse, it goes up and it goes down. To take advantage of this rhythm in a way to fatten our wallets we adopt a swing trade strategy.

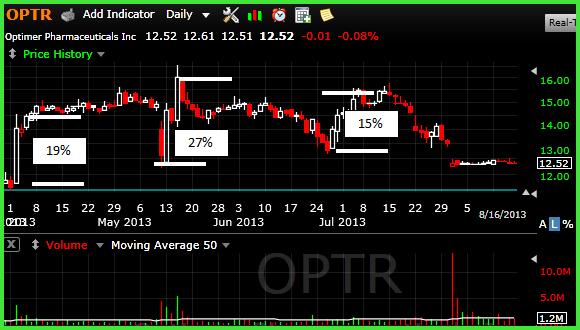

Look at the next chart Fig. 3, which is a recent pharmaceutical company, OPTR. The insets describe the percentage changes between the white lines which represent increases in the stock price. This price pattern is what we call a swing trade, with price moving from a bottom support to a top resistance, and back again. How long a stock remains in this swinging pattern is one issue we deal with in the Provident Investor.

Fig. 3 Swing Trade Opportunities in today’s market.

If that swing trade example doesn’t get you excited, you need oxygen. That is what our new book deals with, along with money-management techniques to reduce risk. So get on board with our introductory sale price at $19.95. (Click on the Provident Investing Book link above) Additionally, we will introduce a Beginning Traders Online course in the coming weeks, using Provident Investing as the course text. Again, the free charting program, “www.freestockcharts.com” will give you all the charting power you need to make this effort a success. A Swing Trade can become as comfortable to execute as riding a bike.

Profundity helps! SiteMap

“Anyone who can spell a word only one way is an idiot.” W.C. Fields

In a word – INSIGHT!